- Home

- >

- News

- >

- Industry News

- >

- What should we do after Reduction of VAT rates per 1 April 2019

What should we do after Reduction of VAT rates per 1 April 2019

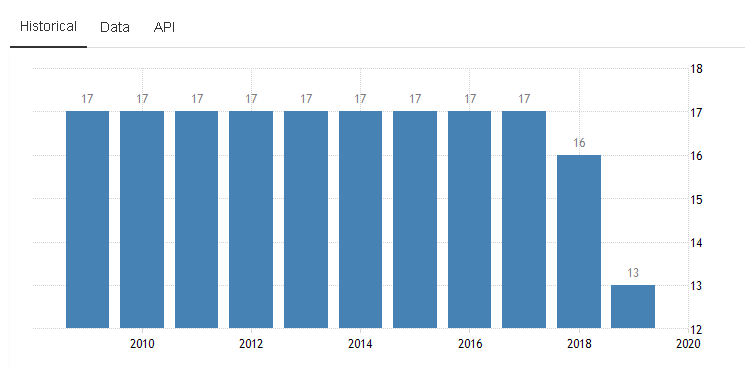

China’s announcement Friday that April 1 will be the implementation date for value-added tax cuts aimed at stimulating manufacturing activity and lowering input costs for companies drew a positive response from commodities market players.

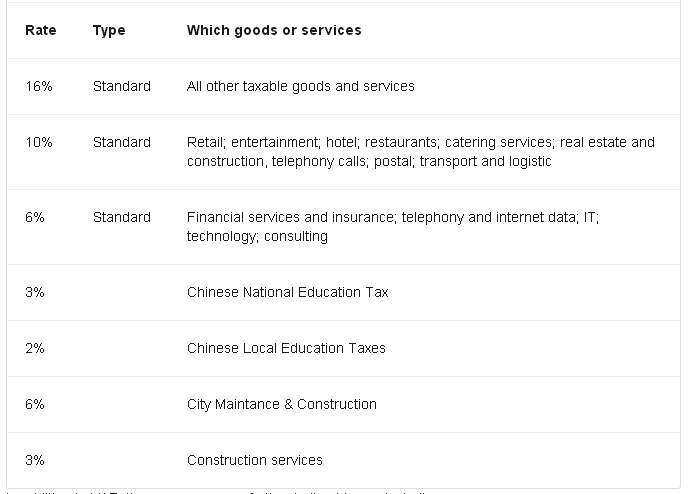

Beijing unveiled stimulus policies on March 5 including VAT cuts in manufacturing to 13% from 16%, and for transportation and construction sectors to 9% from 10%.

The thermal coal market will benefit from a VAT cut of 3 percentage points to 13% as it will help lower costs for end-users like power plants, with China aiming to reduce electricity prices for industrial usage by 10%, traders said.

“Tax is included in our costs, so now seaborne coal traders will also be able to lower their offers to Chinese buyers after the reduction,” a Singapore-based coal trader said.

Most petroleum products like crude oil, gasoline, gasoil, naphtha, jet fuel and fuel oil will see the VAT reduced to 13% from 16%. VAT for LPG and natural gas will be cut from 10% to 9%.

The VAT cut will also marginally lower fuel costs for retail customers, with gasoline prices dropping to around Yuan 7.8/liter from Yuan 8/liter, a refining source in southern China said.

In petrochemicals, while the VAT cuts could boost butadiene exports from China in the longer run, the immediate impact was muted.

This is also suited for our box stitching machine,PE strapping machine,Fully auto stitching machine,so it is big news for us,hope we will develop more oversea market like India,Jordan,Egypt,Vietnam UAE etc.

(If similar,if there is infringement, please contact us to delete,thanks!)